Effective Solutions for a Financially Sustainable Revenue Cycle

Finance leaders are standing at a crossroads. How do you build a strong revenue cycle while healthcare and regulatory environments continue to evolve, and at times, worsen the financial landscape?

In our latest report – 2023 Revenue IntelligenceTM Data and Insights – we look at the leading trends happening in healthcare today and how they both tighten and strengthen margins.

In this report, you’ll learn:

- Why embracing automations can alleviate cost pressures by helping overcome billing turnaround issues

- How patient-focused technologies and workflows help patients keep appointments and pay bills on time

- How a third-party partner can help manage complex claims and hold payers accountable to their obligations

An intelligent revenue cycle is not linear—it is interconnected and iterative to address the entire patient journey and drive best outcomes.

Chris is an experienced finance, RCM and digital leader who has significant experience with forecasting and analyzing revenue trends for several of the nation’s top healthcare providers. He currently leads R1’s patient operations and commercial solutions teams and has more than 14 years’ experience in patient operations, performance management, digital and analytics, and more.

Education: B.B.A. Finance & Marketing, University of Michigan

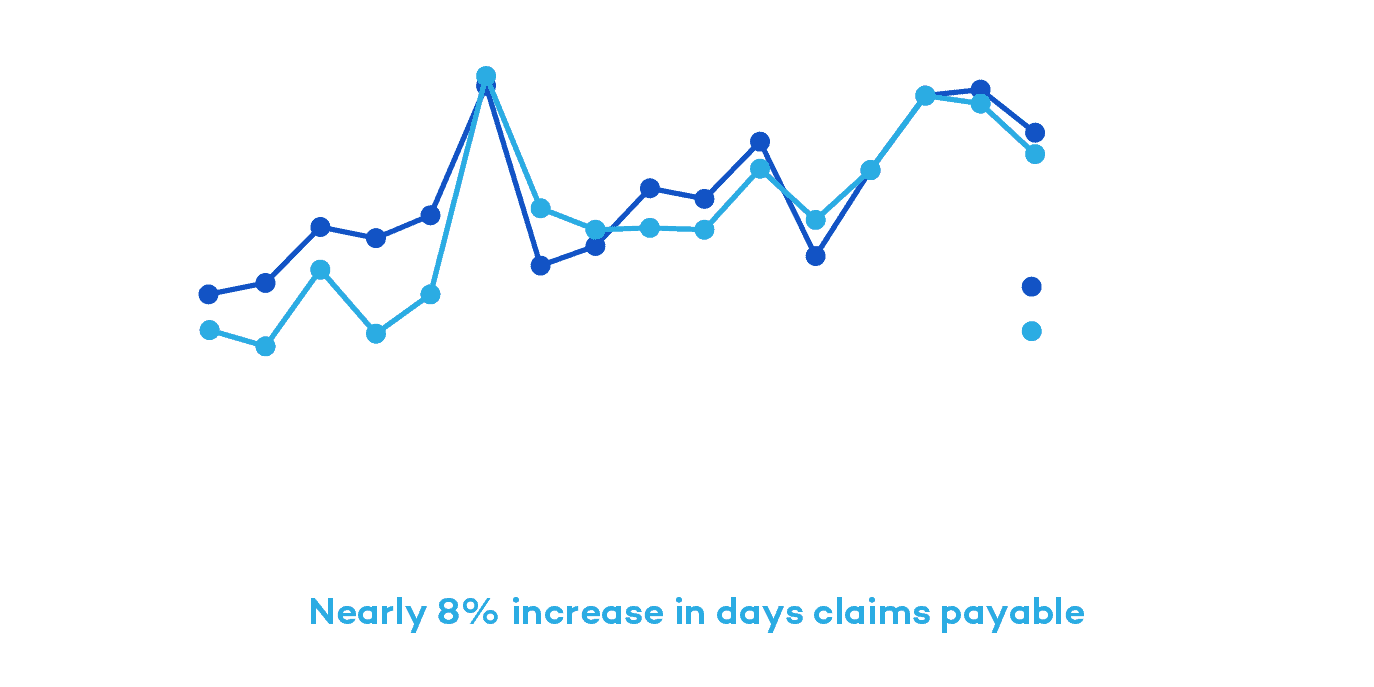

Claims Payable Days Increase Nearly 8% Across Top Commercial Payers Since 2019

From 2019 to 2022, R1 and Cloudmed observed national commercial payers delaying claim adjudication and appeal reviews, especially compared to pre-pandemic levels. There was a steady increase in days claims payable by nearly 8% during that time.

“Payers are not immune to the same staffing challenges that providers face. Coupling with the fact that there was a moratorium on authorization and Level of Care denials during the pandemic, when you release that moratorium, more claims are going to hit the algorithm needing a human review,” Hartemayer explains.

With lagging claims adjudication processes and increasing AR days, it’s important to choose a partner with a global footprint to help payers more proactively follow-up on delayed or denied claims to get ahead of these delays. This will help reduce AR days and capture fuller, expedited payments.

Kate has extensive experience in leading A/R and denials management teams. She focuses her time on building tech-enabled solutions that equip teams and customers with real-time data and solutions to increase revenue and mitigate revenue lags and denials.

Education: M.B.A., Loyola University Maryland

High Dollar Claims Show Material Increase in Remit Days and Denials

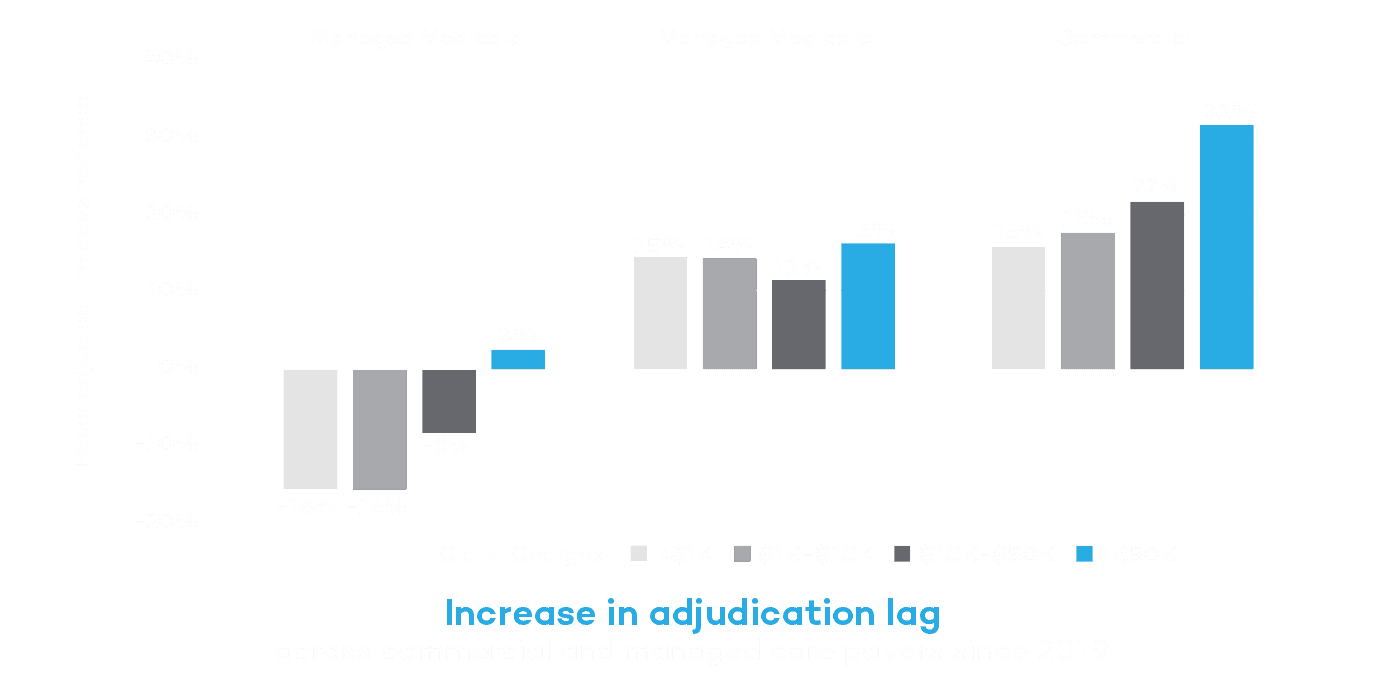

Denials have long been one of the more rigorous points in the RCM journey. For high dollar claims greater than $50,000, commercial payers saw more than a 30% increase in days to adjudicate claims compared to 2019. Exacerbated by increasing claim volumes and labor shortages, hospitals must rethink their approach to denials management.

“The payer adjudication process is starting to lag due to resource and capacity issues. Usually that is clean claim related, meaning there is something wrong with the claim,” Knitter said.

Get the report to learn more about how to get in front of large claim denials and capture more revenue.