How to Maintain Control and Optimize Your Revenue Cycle

Managing a healthy, effective revenue cycle is achievable – even as changing headwinds make the healthcare landscape more turbulent.

In our latest report – 2023 Revenue IntelligenceTM Data and Insights – we cover key trends impacting health systems and provide tips on how positive financial outcomes can be accomplished – all under one efficient and sustainable RCM journey.

In this report, you’ll learn:

- How patient self-service technologies can help cut costs by limiting staffing needs

- How embracing new policies like the No Surprises Act can create a better patient experience and increase patient loyalty

- How trusted third parties can help hospitals quality check documentation for accuracy and prevent charge capture issues

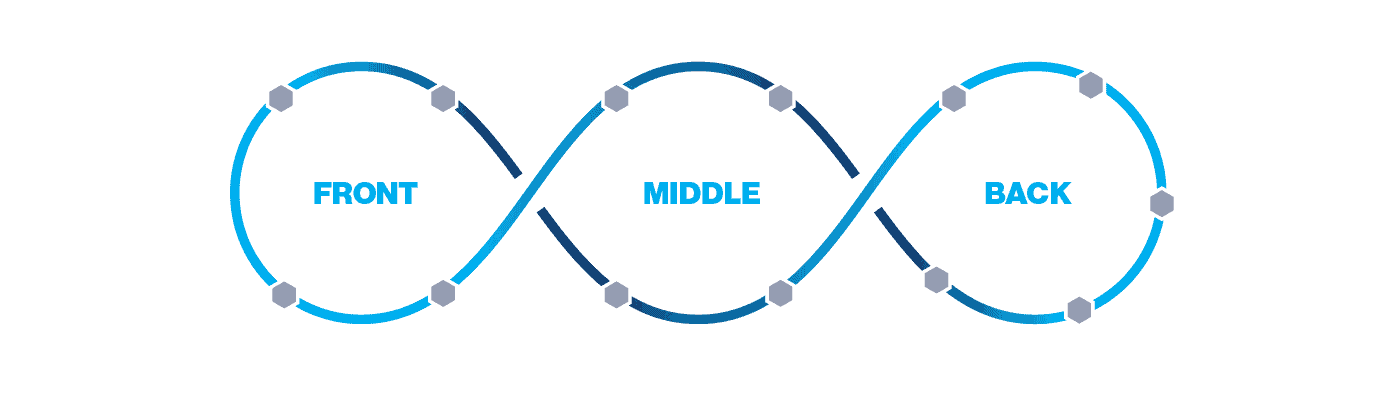

An intelligent revenue cycle is not linear—it’s interconnected and iterative to address the entire patient journey and drive best outcomes.

Chris is an experienced finance, RCM and digital leader who has significant experience with forecasting and analyzing revenue trends for several of the nation’s top healthcare providers. He currently leads R1’s patient operations and commercial solutions teams and has more than 14 years’ experience in patient operations, performance management, digital and analytics, and more.

Education: B.B.A. Finance & Marketing, University of Michigan

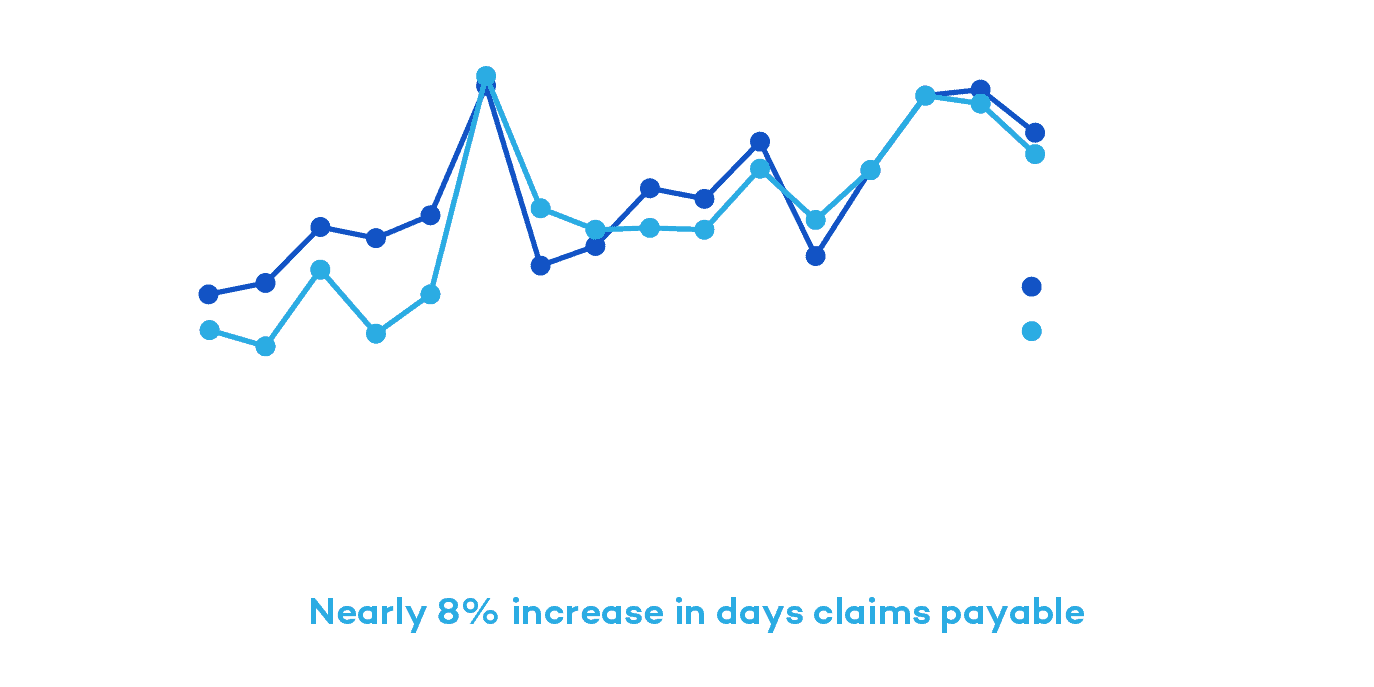

Claims Payable Days Increase Nearly 8% Across Top Commercial Payers Since 2019

From 2019 to 2022, R1 and Cloudmed observed national commercial payers delaying claim adjudication and appeal reviews, especially compared to pre-pandemic levels. There was a steady increase in days claims payable by nearly 8% during that time.

“Payers are not immune to the same staffing challenges that providers face. Coupling with the fact that there was a moratorium on authorization and Level of Care denials during the pandemic, when you release that moratorium, more claims are going to hit the algorithm needing a human review,” Hartemayer explains.

With lagging claims adjudication processes and increasing AR days, it’s important to choose a partner with a global footprint to help payers more proactively follow-up on delayed or denied claims to get ahead of these delays. This will help reduce AR days and capture fuller, expedited payments.

Kate has extensive experience in leading A/R and denials management teams. She focuses her time on building tech-enabled solutions that equip teams and customers with real-time data and solutions to increase revenue and mitigate revenue lags and denials.

Education: M.B.A., Loyola University Maryland

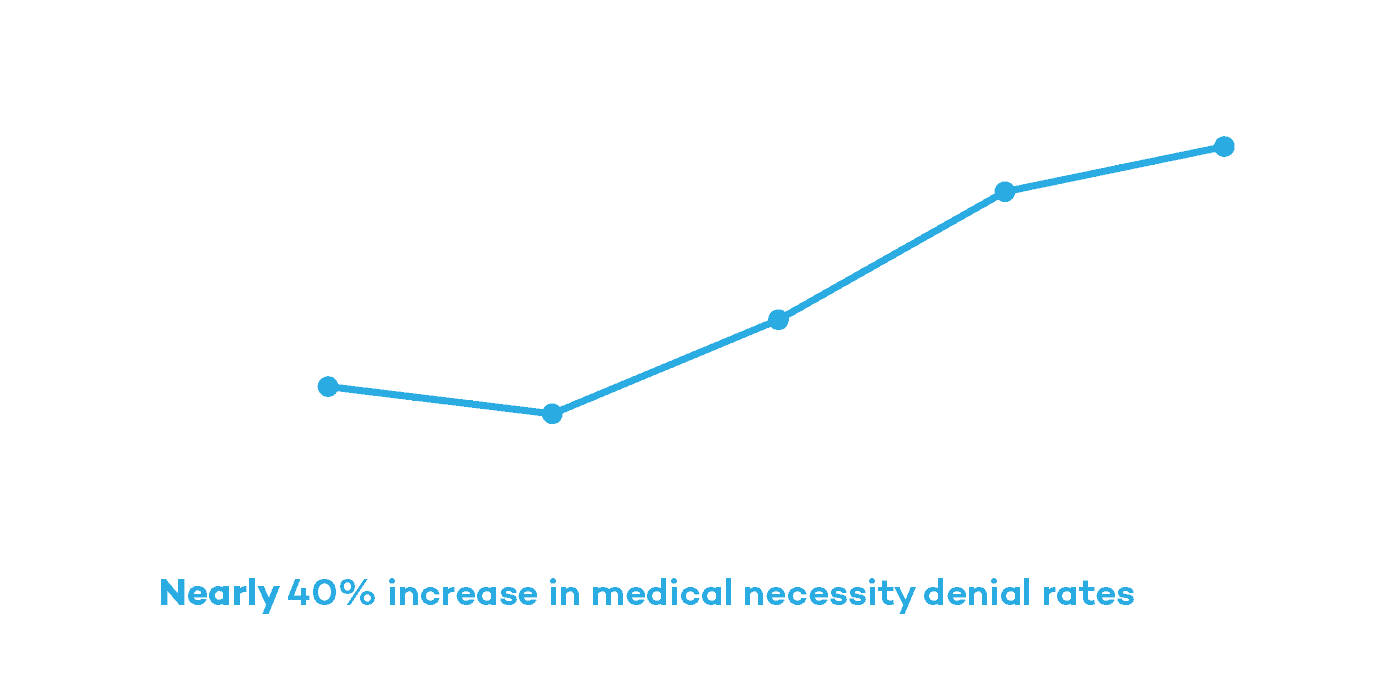

Medical Necessity Denial Rates Increase Nearly 40% for Inpatient Claims

Denials have long been one of the more rigorous points in the RCM journey. From 2019 to 2023, medical necessity denial rates for inpatient claims increased nearly 40%. Exacerbated by increasing claim volumes and labor shortages, hospitals must rethink their approach to denials management.

“The payer adjudication process is starting to lag due to resource and capacity issues. Usually that is clean claim related, meaning there is something wrong with the claim,” Knitter said.

When looking at the top denials hospitals encounter, each require innovative solutions such as working with trusted experts who hold payers to their obligations and embracing new technologies like robotic process automation (RPA) to circumvent labor issues and improve turnaround times.